irrevocable trust capital gains tax rate 2020

Long-term capital gains are usually subject to one of three tax. The highest trust and estate tax rate is 37.

Tax Form 8949 Instructions For Reporting Capital Gains Losses Capital Gain Capital Gains Tax Tax Forms

In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000.

. If assets in the trust appreciate and they are sold by the trustee the profits would not be looked upon as capital gains. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. The value of a persons estate andor lifetime gifts exceeding.

It applies to income of 13050 or more for deaths that occurred in 2021. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. If its in appreciated stock that has to be sold doing so would trigger.

For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in. In 2020 the federal estate and gift tax exemption is 11580000. For tax year 2020 the 20 rate applies to amounts above 13150.

10 of 2650 all. During the lifetime of the grantor any. Because Minnesota taxes resident trusts on all their income and gain and nonresident trusts only pay Minnesota income tax on income properly allocable to Minnesota.

The maximum tax rate for long-term capital gains and qualified dividends is 20. The exemption increases to 11700000 in 2021. The maximum tax rate for long-term capital gains and qualified dividends is 20.

The standard rules apply to these four tax brackets. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return. If taxable income is.

In addition the same threshold applies to the additional 38 percent net. Trust tax rates are very high as you can see here. The trustees take the losses away from the gains leaving no chargeable gains for the.

Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits. The tax rate works out to be 3146 plus 37 of income. So for example if a trust earns 10000 in income during 2021 it would pay the following taxes.

However long term capital gain generated by a trust still. Traditional estate planning is being turned on its head. 2022 Long-Term Capital Gains Trust Tax Rates.

Capital gains and qualified dividends. They would be contributions to the corpus and they would. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and.

A year plus a day isnt really a long time for many investors but its the rule that lawmakers arbitrarily selected. If an irrevocable trust has its own tax ID number then the IRS requires the trust to file its own income tax return which is IRS form 1041. The rate remains 40 percent.

When irrevocable trusts sell assets are capital gains taxes due and if. An individual would have to make over 518500 in taxable income to be taxed at 37. This along with the rate reduction may reduce the tax paid by ESBTs on S corporation income from a maximum of 396 in tax year 2017 to a potential effective rate of.

The tax rate schedule for estates and trusts in 2020 is as follows. For 2020 trusts pay tax at the maximum income tax rate when taxable income exceeds 12950. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable.

Why You Should Break Up With Your Scale In 2020 Breakup Anti Dieting Negative Relationships

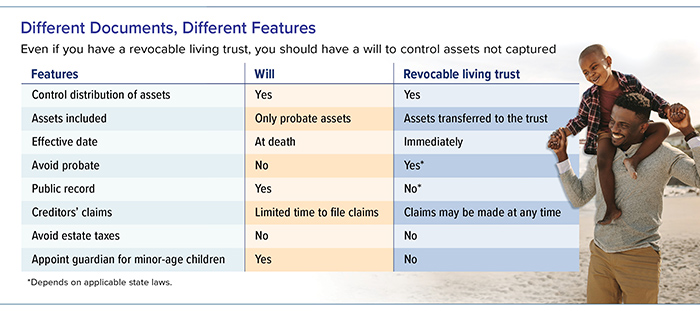

Dachtler Wealth Management Newsletters Will Vs Trust Know The Difference

2021 Trust Tax Rates And Exemptions

How Does A Trust Work Estate Planning Trust Will And Testament

Irrevocable Trusts Brown Hobkirk Pllc

Definitive Guide On Trustee Fees Wealth Advisors Trust Company

Now Is The Time To Do The Math On Charitable Lead Trusts Office Of Gift Planning

How Much Does It Cost To Set Up A Trust Smartasset

Investing In Qualified Opportunity Funds With Irrevocable Grantor Trusts The Cpa Journal

What Is An Irrevocable Trust How Does It Work Free Video Explains

Irrevocable Life Insurance Trusts Graves Dougherty Hearon Moody

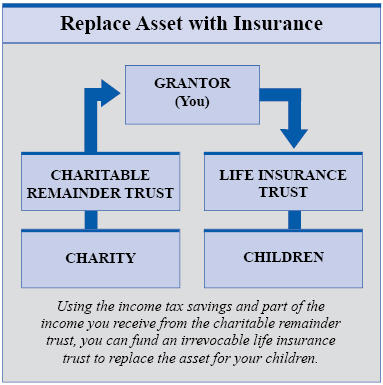

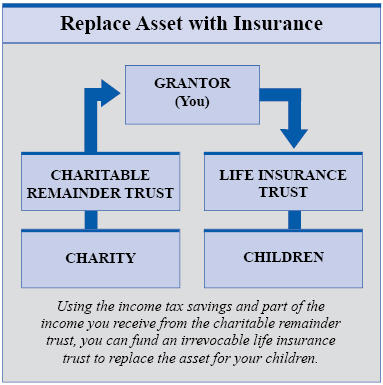

Understanding Charitable Remainder Trusts Buckley Law

Dsssb Recruitment 2020 Latest Updates Letsaskme Guest Blogging Recruitment Blog Posts

Complete Irrevocable Trust Deductions Tax Guide Regnum Legacy

2021 Trust Tax Rates And Exemptions

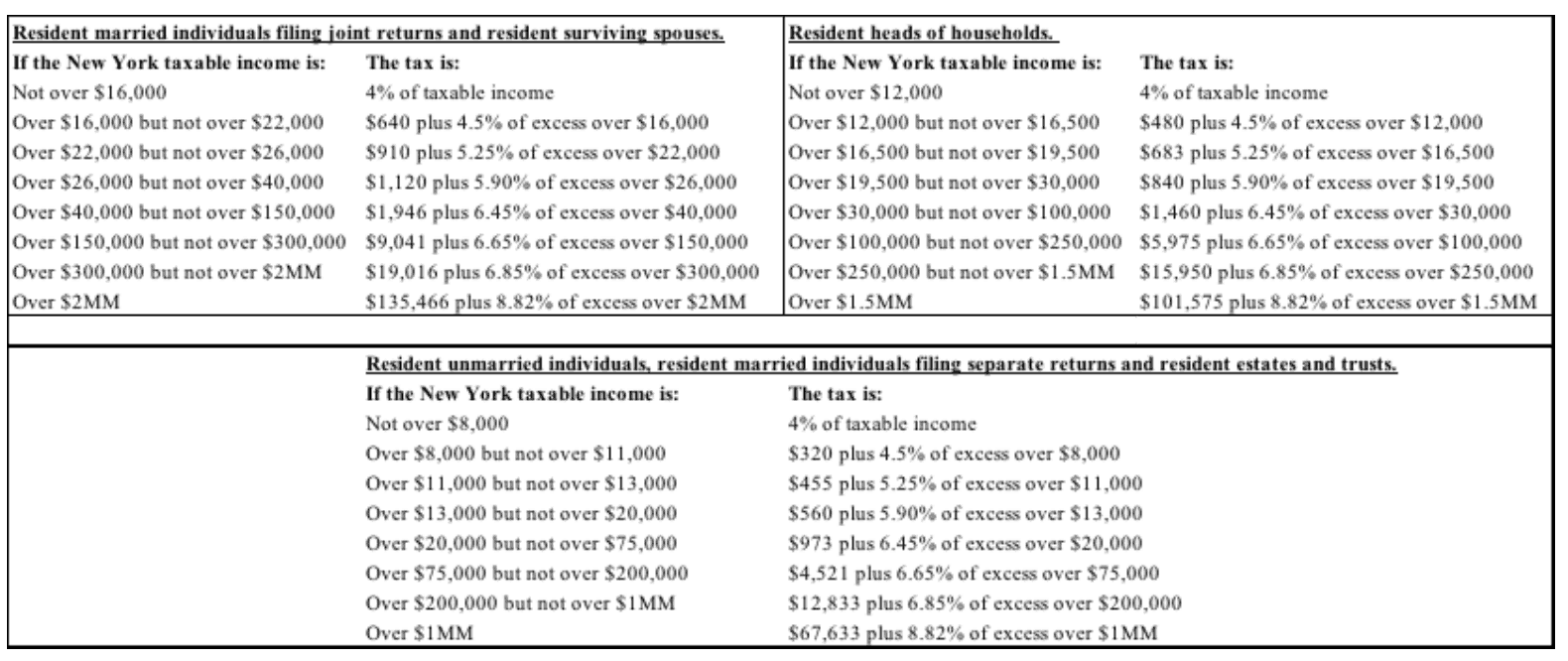

New York Resident Trust Vs An Individual Tax Rate

Now Is The Time To Do The Math On Charitable Lead Trusts Office Of Gift Planning

Can I Change My Irrevocable Trust The American College Of Trust And Estate Counsel

What Is An Irrevocable Trust How Does It Work Free Video Explains